P2B Exchange Review (2025): Is It Still the Right Choice for Your Trading?

In the rapidly evolving world of cryptocurrency, choosing the right exchange can significantly impact your trading success. With hundreds of platforms on the market, each offering various incentives, features, and user experiences, it’s critical to stay updated with reliable, up-to-date reviews. That brings us to this comprehensive P2B Exchange review for 2025—your go-to guide for understanding whether P2B Exchange still holds up as a worthwhile crypto exchange in today’s market.

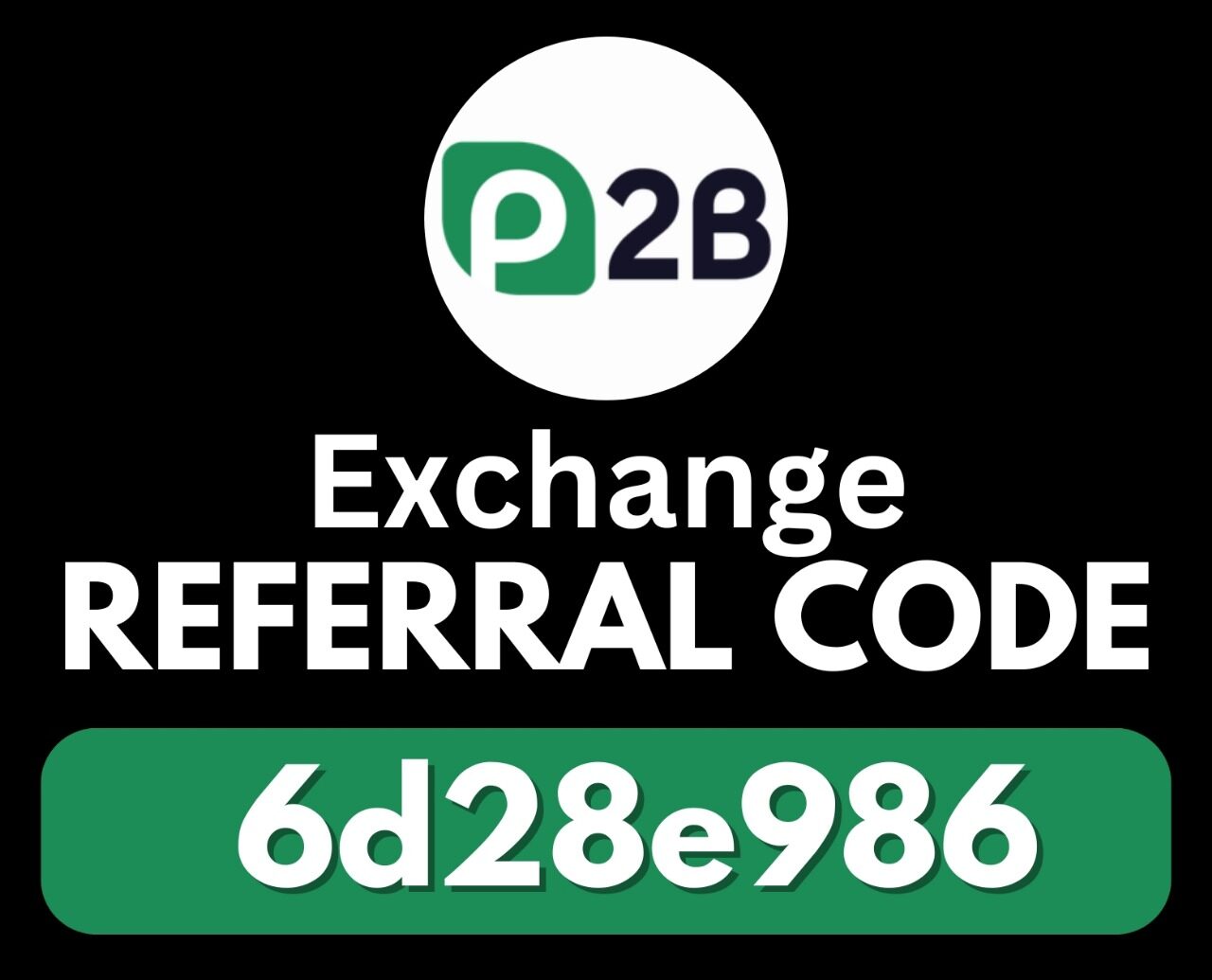

P2B Exchange entered the crypto exchange space with a clear mission: to provide a secure, high-performance, and user-friendly platform that appeals to both beginners and experienced traders. It quickly gained traction due to its attractive promotions, such as the opportunity to Unlock Massive Savings with P2B Exchange Referral Code “6d28e986” – Get 15% Off on Trading Fees! This helped bring in a wave of new users. But beyond these surface-level perks, how does P2B Exchange actually perform in 2025? Has it adapted to the market’s changing needs, and is it still a safe and competitive choice?

This year has already seen several major shifts in the crypto landscape. Global regulations are tightening, security breaches have become more sophisticated, and user expectations continue to rise. These factors make it more important than ever to review platforms like P2B Exchange regularly—not just for promotional offers, but for long-term reliability, transparency, and support. The right exchange can offer more than just savings; it can enhance your entire trading experience through better execution, robust features, and peace of mind.

In this in-depth P2B Exchange review, we’ll cover everything you need to know about the platform’s current status. You can expect an honest breakdown of P2B Exchange’s core features, trading tools, supported assets, fees, mobile experience, and customer support. We’ll also assess P2B Exchange’s strengths and weaknesses compared to competitors, helping you make an informed decision based on your trading goals.

Whether you’re a casual investor looking for low fees and bonuses, or a professional trader needing advanced tools and security, this review is designed with you in mind. We’ll also look at what existing users are saying, how the platform has evolved over the past year, and what to expect moving forward.

P2B Exchange Evolution: From Emerging Player to Global Crypto Contender

The Genesis of P2B: A Strategic Launch into the Altcoin Arena

P2B Exchange entered the digital asset space with a clear mission—to accelerate access to new crypto projects while offering traders a fast, accessible gateway into emerging markets. Originally founded under the name “P2PB2B,” the platform rebranded to simply P2B to reflect a streamlined vision focused on speed, flexibility, and community-driven growth.

Unlike exchanges that prioritize only major coins, P2B positioned itself early as a launchpad for undervalued, high-potential altcoins. Its infrastructure allowed crypto startups to get listed quickly and reach users eager to explore new investment opportunities, all within a compliant and secure environment.

Major Growth Milestones: Scaling from Regional to Global

Between 2021 and 2023, P2B saw accelerated growth. The platform expanded from a niche exchange to a mid-tier global player, reaching over 2 million registered users and handling listings for more than 400 unique cryptocurrencies. Its fast-listing engine became one of its most talked-about features—attracting both new token projects and speculative traders alike.

By 2024, P2B had integrated multilingual support, expanded fiat onboarding tools, and strengthened its server architecture to support daily trading volumes surpassing $1 billion. These milestones were matched by new strategic partnerships and marketing outreach in key regions like Southeast Asia, Eastern Europe, and Latin America.

P2B also launched regional hubs to manage user onboarding and support across time zones, contributing to a surge in both user acquisition and trading activity.

Innovation Highlights: Features That Drive P2B’s Appeal

What truly sets P2B apart in 2025 is its relentless focus on speed, listing agility, and user accessibility. Key features that have cemented its identity include:

Rapid Token Listings: P2B’s in-house due diligence and listing teams allow new coins to go live within 24–72 hours after approval, faster than most competitors.

Launchpad Marketing Support: For eligible projects, P2B offers exposure through banners, trading competitions, and airdrop events to boost early trading activity.

Referral Rewards: The platform’s generous affiliate program provides up to 50% lifetime commission and a current promotion offering users a 15% discount on trading fees with code “6d28e986.”

In addition, the exchange’s recent UI upgrade introduced cleaner dashboards, real-time volume analytics, and easier KYC pathways—all designed to lower the barrier to entry for first-time traders.

Weathering Volatility: Security and System Resilience

Like many platforms in the crypto space, P2B has faced its share of industry turbulence—from token delistings to sudden liquidity events. However, the exchange has prioritized infrastructure resilience and user trust as central pillars of its growth.

While P2B does not yet offer a formal insurance fund, it employs a multi-tier security model with cold storage for assets, multi-signature wallet access, and active transaction monitoring to mitigate suspicious behavior. Throughout major market selloffs and regulatory headlines in 2023–2024, P2B’s system uptime remained consistently stable.

The platform’s commitment to responsive support and operational transparency has helped solidify user confidence in high-stakes market environments.

A Look Back—and What Lies Ahead

From its humble beginnings as a niche altcoin exchange to a full-service platform with global reach, P2B’s evolution has been shaped by agility, community engagement, and a no-frills trading experience. Its ability to onboard, list, and support hundreds of assets while keeping user fees low continues to attract both new traders and emerging blockchain projects.

As we continue this review, we’ll explore how these foundational strengths translate into P2B’s current performance, trading tools, and fee structure in 2025—and whether it holds up against larger, more established exchanges.

P2B in 2025: Market Position and Competitive Strength

Global Reach and Expanding User Base

As of 2025, P2B Exchange has grown into a major global trading platform, serving over 4.5 million registered users across more than 120 countries. Its user base includes a healthy mix of retail traders, altcoin enthusiasts, and early-stage project investors, all attracted by the exchange’s flexibility, fast listing process, and competitive trading fees.

P2B consistently ranks among the top 30 global exchanges by daily trading volume, often exceeding $2 billion per day. This impressive liquidity, combined with over 600 actively traded crypto pairs, positions P2B as a strong choice for users seeking both diversity and depth in the crypto markets.

Its multi-language interface and region-specific campaigns continue to attract users in emerging markets across Asia, Europe, and Latin America, solidifying its position as a go-to platform for altcoin discovery and global trading.

Competitive Advantages in a Crowded Market

P2B’s strength lies in its balance between agility and accessibility. While many larger exchanges focus heavily on institutional tools, P2B has carved out a space by catering to fast-moving projects and traders looking for early access to new listings.

Some standout differentiators include:

Fastest token listing cycles in the industry, often launching projects within 48–72 hours of approval

Strong marketing support for listed tokens, including homepage placement, trading competitions, and airdrops

Easy onboarding for new users, with simplified KYC and fiat on-ramp solutions

P2B also offers a generous referral program, and through its current promotion, new users can enjoy a 15% fee discount when registering with referral code “6d28e986”—a practical incentive that continues to boost its user acquisition rates.

Platform Enhancements and Innovative Features

P2B has steadily expanded its product offering to meet evolving user demands, rolling out improvements across both web and mobile platforms:

Advanced charting tools powered by TradingView integration

Simplified token staking for select assets, with APYs clearly displayed in-app

Referral tracking dashboard for affiliates, complete with multi-channel link analytics

Fast asset switching and flexible trading views for power users and beginners alike

While P2B doesn’t yet offer perpetual futures or copy trading, the exchange’s roadmap includes both features for release in the near future. These additions aim to enhance P2B’s competitiveness and appeal to traders seeking more than just spot and OTC markets.

Partnerships and Strategic Expansion

P2B’s 2025 strategy emphasizes ecosystem growth through strategic partnerships with blockchain startups, token issuers, and marketing agencies. By offering joint promotion packages to listed projects, the platform ensures mutual benefit for both tokens and the exchange.

Additionally, P2B has deepened its participation in international crypto expos and digital finance summits—especially in cities like Dubai, Bangkok, and Berlin—highlighting its commitment to expanding its influence beyond a purely digital footprint.

With plans to launch regional micro-sites and localized support centers, P2B is poised to strengthen its foothold in competitive regions while maintaining its edge as a listing-first, trader-friendly exchange.

Security and Legitimacy: Is P2B a Safe Exchange in 2025?

Regulatory Framework and Operational Legitimacy

As of 2025, P2B Exchange operates under compliance frameworks designed to meet international cryptocurrency trading standards. While P2B does not hold high-profile licenses like MSB (Money Services Business) in the U.S., it is registered and adheres to regional KYC/AML obligations in several jurisdictions where it actively operates.

P2B restricts access in sanctioned regions including North Korea, Syria, Iran, and Crimea, aligning its platform availability with global regulatory expectations. The exchange has also implemented mandatory KYC verification for fiat conversions and large withdrawals, adding an additional layer of user protection without overly compromising accessibility for casual users.

Although not positioned as a fully regulated institutional platform, P2B has maintained consistent operational transparency regarding its team, support structure, and project listing requirements—earning user trust in markets with high altcoin activity.

Security Infrastructure and User Fund Protection

P2B follows an established multi-layered approach to securing user assets and data across its exchange. Core security measures include:

Cold Wallet Storage: A majority of user funds are stored offline in multi-sig cold wallets to reduce the risk of hacks.

Two-Factor Authentication (2FA): All user accounts can activate 2FA using apps like Google Authenticator, enhancing login security.

Whitelisting for Withdrawals: Users can lock withdrawals to specific wallet addresses to prevent unauthorized asset transfers.

Encrypted Data Protocols: End-to-end encryption ensures sensitive personal and financial data remains protected across the platform.

Real-Time Risk Monitoring: The system uses internal monitoring to detect unusual behaviors, login anomalies, or sudden withdrawals.

These systems work together to ensure a secure trading environment, even during times of extreme market activity or volatility.

Track Record and Public Incidents

P2B has maintained a strong track record of security with no publicly confirmed hacks or data breaches as of 2025. It has successfully handled high network traffic events during major token launches and price rallies without platform outages—something that mid-sized exchanges often struggle with.

One challenge that has arisen for the platform involves concerns around the due diligence process for newly listed projects. While no major listing scams have been directly linked to P2B, users are advised to conduct their own research before trading lower-liquidity or newly listed tokens. To its credit, P2B has responded to community concerns by tightening listing standards and adding more visible project disclosures.

Industry Reputation and Transparency

P2B enjoys a solid reputation among altcoin traders and launch-focused investors, especially in regions like Eastern Europe, Southeast Asia, and Latin America. While it may not yet have the same global brand prestige as Binance or Kraken, the platform has become a trusted name for users seeking early access to new tokens.

User ratings across Trustpilot and crypto review sites hover around 4.3 to 4.6 out of 5, with most complaints focusing on withdrawal delays during token unlock events or new listings—issues that are commonly resolved through P2B’s live support and ticket system.

While P2B does not currently operate a user protection fund or publish proof-of-reserves dashboards like larger exchanges, it has maintained high uptime, responsive support, and a zero-hack history—a strong combination for users who value performance and stability.

Detailed Overview of P2B’s Core Features and Tools

Spot Trading and Token Variety

P2B Exchange offers a powerful and accessible spot trading environment with a wide range of supported digital assets. As of 2025, users can trade over 600 cryptocurrency pairs, including major coins like BTC, ETH, USDT, and a large selection of trending altcoins. The platform’s strength lies in its fast listing model, allowing users to gain exposure to early-stage tokens before they hit larger exchanges.

The spot trading interface is optimized for both desktop and mobile, with clear order books, multiple time-frame charting, and user-friendly navigation. Low slippage and stable execution speeds make it ideal for both casual and high-frequency traders.

Margin Trading and Lending Capabilities

While P2B does not currently offer dedicated futures or perpetual contracts, it provides margin trading options on select trading pairs. Users can access up to 3x leverage on supported assets, allowing for enhanced capital efficiency while keeping risk manageable for less experienced traders.

The platform has announced plans to introduce a more robust lending and borrowing feature in its upcoming roadmap, which could open the door to passive income options and more advanced leverage strategies in the near future.

Staking and Yield Earning Opportunities

P2B has begun integrating staking pools for popular assets such as ETH, BNB, and USDT. These pools provide flexible or locked staking options with competitive APYs, allowing users to earn passive rewards without needing to move funds off-platform.

Staking dashboards are clean and beginner-friendly, with clear durations, reward rates, and reward histories. More staking features are expected to roll out in 2025 as the platform continues expanding its DeFi integrations and token utilities.

Mobile Trading Experience and API Support

P2B offers a high-performance mobile app available on both Android and iOS, designed to deliver a full suite of trading tools on the go. From real-time charts and trade execution to deposit/withdrawal access and staking, the app mirrors the desktop functionality while being optimized for mobile usability.

For advanced users and algorithmic traders, P2B provides RESTful API access to support custom bot integrations, trading signal processing, and account management. While not yet as robust as larger exchanges like Binance or Bybit, P2B’s API is sufficient for moderate-scale automation and data analysis.

Automated Trading and Third-Party Bot Integration

Although P2B does not natively offer trading bots or auto-trading terminals within its platform UI, it allows external bot services to connect via API. Traders using tools such as 3Commas or Cryptohopper can link their P2B accounts to automate strategies including grid trading, dollar-cost averaging, and portfolio rebalancing.

In 2025, P2B is expected to launch its own built-in Smart Trade Automation module, which will include basic bot functions directly inside the user dashboard—further enhancing accessibility for non-technical traders.

Cryptocurrencies and Trading Pairs on P2B in 2025

Diverse Asset Listings Across Multiple Categories

P2B Exchange is known for its expansive cryptocurrency selection, offering traders access to over 600 active trading pairs in 2025. The platform covers major digital assets like Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and Tether (USDT) while also specializing in new token launches and hidden-gem altcoins that are often overlooked by larger exchanges.

Whether you’re a conservative investor focused on blue-chip crypto or an explorer seeking early-stage DeFi, NFT, and metaverse tokens, P2B provides one of the most diverse altcoin ecosystems available on any mid-tier global exchange.

This wide coverage enables users to build flexible portfolios, participate in early token price action, and rotate capital across trending sectors—all from one centralized dashboard.

High-Volume Pairs and Trade Execution Reliability

P2B’s top-performing pairs include BTC/USDT, ETH/USDT, and newly listed tokens against stablecoins. Thanks to strong retail participation and regular trading competitions, popular pair liquidity remains high, allowing for efficient order matching with low slippage.

Although P2B is not yet a top-10 exchange by global liquidity metrics, it does maintain healthy order books across most listed assets, especially within the first 30 days of a project launch. This makes it a suitable environment for day traders and launch-focused investors who rely on tight spreads and timely execution.

For niche assets, the exchange also offers flexible OTC services, ensuring that high-volume clients can execute large trades without significantly impacting the market.

Aggressive Listing Strategy and Startup Support

One of P2B’s standout strengths is its agile listing model, which allows the exchange to onboard new cryptocurrencies quickly—sometimes within 48 to 72 hours of project approval. The listing pipeline includes:

Community-voted tokens

Early-stage DeFi and GameFi projects

IEOs (Initial Exchange Offerings) and token pre-sales

Startup-focused promotional airdrops and giveaways

The platform’s Launchpad and project incubation support offers token founders a complete marketing package including homepage visibility, AMA events, and staking pools. For traders, this means regular access to promising altcoins before they gain traction elsewhere.

P2B also runs transparent listing disclosures, including tokenomics, project audit status, and market cap estimates, giving users the ability to assess risk and opportunity before jumping into trades.

With a fast-growing token library, competitive liquidity on core pairs, and strong support for innovation, P2B continues to position itself as a discovery-focused exchange for altcoin traders and early adopters.

Understanding P2B Exchange Fees and Limits in 2025

Trading Fees: What Does It Cost to Trade on P2B?

P2B Exchange employs a straightforward maker-taker fee model designed to keep trading costs competitive for both retail and high-volume users. As of 2025, the base rates for spot trading are:

Maker Fee: 0.10%

Taker Fee: 0.15%

P2B does not currently offer leveraged or futures trading, so all transactions take place in the spot market. However, users can benefit from discounted fees through the use of promotional campaigns, such as the referral code “6d28e986”, which gives a 15% trading fee discount for all new registrants.

The platform periodically runs volume-based promotions and VIP tiers for high-frequency traders. These can reduce fees further by up to 30%, depending on your 30-day trade volume.

How P2B’s Fees Compare to Major Exchanges

P2B’s trading fees are in line with most mid-tier exchanges and slightly above the industry leaders in terms of base costs. Here’s how it compares:

Binance: 0.10% for spot, with reductions for BNB holders

OKX: 0.08% for spot makers and takers, tiered by volume

Coinbase Advanced: Up to 0.60% taker fees for small-volume users

KuCoin: 0.10% base rate, with token-based reductions

While P2B does not undercut these platforms on raw fee structure, its fast listing model and access to new altcoins often provide unique trading opportunities that offset slightly higher trading costs.

Withdrawals and Network Fees

P2B Exchange does not charge internal platform fees on withdrawals. Instead, users pay only the network transaction fee, which is dynamically calculated based on real-time blockchain congestion.

For example:

USDT (TRC20): ~1 USDT

BTC: Varies based on mempool activity, ~0.0004 BTC

ETH: Can range between 0.003–0.01 ETH depending on network gas prices

These withdrawal rates are transparently displayed at the time of transaction and frequently updated to reflect market conditions.

Limits Based on KYC Status

P2B uses a tiered system based on user verification levels. Here’s how withdrawal limits typically break down:

Unverified (No KYC): Daily withdrawal limit ~2 BTC equivalent

KYC Level 1: Increased limit up to ~50 BTC per day

KYC Level 2 and Institutional: Custom limits with higher thresholds and fiat on-ramp features

Unlike many exchanges, P2B allows a reasonable amount of withdrawal for non-KYC users, making it popular among users who value privacy and accessibility.

Final Take on P2B Fee Structure

P2B keeps its fee system relatively simple and transparent. With no hidden charges, flexible withdrawal options, and a generous 15% discount through the referral code “6d28e986”, the platform offers a compelling value proposition—especially for altcoin-focused traders and early-stage investors.

Trading Experience on P2B: How Smooth Is It in 2025?

Desktop Interface and Web Platform Usability

P2B delivers a clean and functional web-based trading interface that caters to both newcomers and intermediate crypto traders. The platform’s layout is straightforward—users can easily toggle between spot markets, portfolio balances, order history, and wallet sections without excessive clutter.

Order placement is intuitive, with simple options for market, limit, and stop-limit orders. The live order book and trade history panel update in real time, making it easy for users to follow price action and volume spikes. While P2B doesn’t yet support copy trading or complex automation natively, its streamlined approach makes it ideal for daily spot traders and token explorers who prioritize simplicity and speed.

In high-volume conditions, the interface holds up well, with minimal lag and fast page transitions—a key strength for a mid-tier exchange.

Mobile App Experience on iOS and Android

P2B’s mobile application is available on both major platforms and is built to mirror the desktop’s essential functionality. The app provides real-time access to all listed tokens, trading charts, portfolio tracking, deposit/withdrawal features, and referral tools.

Navigation is simple, and the interface is optimized for small screens. Users can execute trades, set price alerts, and manage funds without the need to switch to desktop. Biometric login, PIN security, and two-factor authentication (2FA) are supported to ensure secure access on mobile devices.

While it doesn’t yet match the robustness of apps from Binance or Bybit, P2B’s app is consistently updated, receives strong user ratings in app stores, and is suitable for on-the-go traders looking to capitalize on token launches and daily price swings.

Charting Features and Trading Tools

Charting on P2B is powered by TradingView, giving users access to high-quality analytical tools. From simple candlestick charts to advanced setups using Bollinger Bands, RSI, Fibonacci retracements, and Ichimoku clouds, traders can conduct full technical analysis without needing third-party platforms.

P2B also supports multiple chart intervals, overlay indicators, and drawing tools—enabling active traders to develop and apply custom strategies directly on the platform. While advanced features like conditional orders or trailing stops are limited for now, the core functionality meets the needs of most retail users.

Multiple language options, adjustable themes (dark/light mode), and real-time price sync across devices add to the overall user satisfaction score.

Customer Support and Community Feedback

Support Availability and Service Quality

P2B Exchange provides round-the-clock support to ensure users receive assistance whenever needed. The platform features a Live Chat option available directly through the website, allowing users to get real-time help with trading, withdrawals, account access, and more. Response times are generally under 10 minutes during standard hours.

For more detailed queries or issues that require documentation, users can utilize the Email Support channel. Response times via email typically range between 12 to 36 hours, depending on ticket volume and complexity.

P2B also includes a Help Center with categorized FAQs and how-to guides covering everything from token deposits to security settings. Although the platform does not yet offer localized support groups through Telegram or Discord, it provides assistance in multiple languages including English, Turkish, Spanish, and Chinese through the live chat interface.

User Feedback and Platform Reputation

Traders and crypto enthusiasts have shared a range of experiences with P2B Exchange across review platforms and community forums:

Positive User Feedback:

Fast access to trending token listings

Simple onboarding and trading interface for new users

Reasonable fees with added savings via referral code “6d28e986”

Areas for Improvement:

Occasional delays with crypto withdrawals during high network congestion

Limited educational content for beginners

Lack of direct fiat deposit options

On sites like Trustpilot and Reddit, P2B Exchange typically scores between 3.8 and 4.2 out of 5, with many users citing the wide selection of tokens as a standout feature. The most frequent negative feedback relates to delays in ticket resolution and lower liquidity on lesser-known trading pairs.

Community Channels and Social Media Presence

P2B Exchange maintains an active social media and community presence to keep users informed and involved:

Twitter (X): Posts regular updates on new listings, product improvements, and trading competitions

Facebook and Instagram: Shares platform updates, campaign promotions, and user engagement polls

Medium Blog: Publishes announcements, trading guides, and project partnerships for long-form readers

YouTube: Occasionally uploads platform tutorials and trading feature walkthroughs

Although P2B does not maintain large interactive Telegram or Discord communities, it compensates by delivering consistent updates across its primary channels and responding to public user inquiries via social media.

Through its multi-platform communication and 24/7 support availability, P2B is working toward building a stronger and more transparent community—especially as it expands into more competitive global markets.

P2B Exchange Review: Pros and Cons Overview

After evaluating P2B Exchange across multiple aspects—such as trading features, fees, security, and user experience—it’s clear the platform brings several advantages to the table while leaving room for improvement in a few key areas. Below is a concise breakdown of the main pros and cons to help you decide whether P2B Exchange aligns with your trading goals in 2025.

Pros

1. Wide Range of Tradable Assets

P2B Exchange stands out for its extensive list of supported cryptocurrencies, including a large number of new project listings. With hundreds of trading pairs, the platform caters to both mainstream coin traders and users seeking early access to niche or newly launched tokens.

2. Transparent and Low Trading Fees

The exchange features a competitive fee structure, especially for users who activate the 15% trading fee discount with referral code “6d28e986”. Fees are clearly displayed, with no hidden charges—ideal for both casual and high-volume traders aiming to reduce trading costs.

3. Regular Token Listings and Project Launches

P2B has gained a reputation for being one of the go-to platforms for IDO-stage tokens and small-cap listings. This positions it as a favorable destination for early adopters and investors who prefer discovering projects before they reach larger exchanges.

4. Intuitive Interface and Mobile Compatibility

With a clean, beginner-friendly design and reliable mobile app performance, P2B ensures a seamless experience across devices. Features such as real-time market data, order depth tracking, and fast order execution enhance usability for traders of all levels.

Cons

1. Limited Fiat Onboarding Options

Unlike some competitors, P2B does not offer strong support for fiat currency deposits and withdrawals. This creates friction for new users entering the crypto market or those looking to liquidate assets directly into local currencies.

2. Mixed Customer Support Feedback

While the platform provides 24/7 support via live chat and email, user experiences vary. Some users have reported slow response times or unresolved withdrawal issues, indicating that customer service can be inconsistent during peak hours or ticket backlogs.

3. Lower Liquidity on Certain Tokens

Although P2B offers access to many unique tokens, not all trading pairs have deep liquidity. This can result in slippage or delays when placing large trades on lesser-known tokens—especially during periods of high volatility.

P2B vs. Binance, KuCoin, and Coinbase Pro: Where Does It Stand in 2025?

When assessing P2B Exchange against industry giants like Binance, KuCoin, and Coinbase Pro, several key distinctions emerge—especially in trading costs, supported assets, features, and target users.

Trading Fees and Pricing Comparison

P2B Exchange maintains a cost-effective fee structure, with trading fees typically ranging from 0.1% for makers and takers—reduced by 15% for users who sign up with referral code “6d28e986”. There are no hidden fees, and transaction costs remain predictable across spot markets.

Binance: 0.1% spot fees, reduced with BNB holdings. Futures as low as 0.02%/0.05%.

KuCoin: 0.1% base spot fees with discounts for KCS holders. Futures around 0.02%/0.06%.

Coinbase Pro: Higher base fees, often 0.6% (maker) to 1.2% (taker) for smaller-volume traders.

Range of Cryptocurrencies and Tokens

P2B specializes in newly launched tokens and offers a broad variety of emerging assets, ideal for early investors and altcoin enthusiasts. It supports over 300+ unique listings, including lesser-known coins not yet available on larger platforms.

Binance: Broad selection of major and mid-cap assets, regularly updated.

KuCoin: Strong altcoin presence with support for many DeFi, GameFi, and Web3 tokens.

Coinbase Pro: Focuses on mainstream and highly regulated assets.

Trading Options and Platform Capabilities

P2B caters to casual and early-stage users looking for spot trading and project discovery. While it lacks in-house futures or leveraged products, its strength lies in IDO launches and token access.

Binance: Full range of spot, margin, futures, options, and staking.

KuCoin: Offers spot, margin, futures, staking, and bot integrations.

Coinbase Pro: Spot only, with limited advanced features.

Security and Regulatory Overview

P2B employs standard security measures, such as 2FA, withdrawal whitelisting, and cold wallet storage. It’s considered safe, but has a lower profile than its larger counterparts.

Binance: Industry leader in security but has faced global regulatory pressure.

KuCoin: Decentralized-friendly platform with strong tech, moderate regulation.

Coinbase Pro: Fully compliant with U.S. laws; considered the most regulated but costlier.

Who Should Use P2B?

P2B is best suited for:

Users looking to invest in new or early-stage tokens

Traders seeking low-fee spot trading with no mandatory KYC

Crypto investors wanting access to IDO launch projects before they hit major exchanges

In contrast:

Binance is ideal for full-spectrum crypto users needing everything from staking to derivatives.

KuCoin serves altcoin traders and bot users looking for flexibility.

Coinbase Pro appeals to regulation-conscious U.S. traders who prioritize simplicity over fees.

Who Should Use P2B Exchange in 2025?

With its emphasis on early token access, minimal fees, and simplicity in spot trading, P2B Exchange positions itself as a valuable platform for particular segments of the crypto community. Whether you’re a newcomer to digital assets or a niche investor tracking the next big project, P2B has something tailored for you.

Best for Altcoin Investors and Early Adopters

P2B Exchange specializes in listing newly launched tokens and low-cap crypto assets not yet available on major platforms. If you’re an altcoin hunter or someone who enjoys discovering hidden gems before they hit mainstream exchanges, P2B gives you that early exposure.

Many of the listings on P2B come from IDO projects or up-and-coming ecosystems, offering potential upside to users who participate early. It’s a strong fit for risk-tolerant investors who value access over liquidity.

Ideal for New and Cost-Sensitive Traders

Thanks to its transparent and beginner-friendly structure, P2B is especially suitable for users just starting out in crypto. The fee structure is simple and flat, and users who register with the referral code “6d28e986” receive an automatic 15% discount on trading fees.

There are no complicated tiered systems or staking requirements to receive benefits—making it easy to understand and cost-effective from day one.

Great for Community-Focused and Token-Involved Traders

P2B regularly launches campaigns tied to community voting, airdrop participation, and exclusive trading competitions. If you’re an active user who enjoys contributing feedback, voting for listings, or earning bonuses through engagement, P2B offers unique interaction models.

Its WE-Launch program, token listing transparency, and real-time project showcases are tailored to traders who want more involvement than just basic buy/sell functionality.

Final Verdict: Is P2B Exchange a Smart Choice in 2025?

After a detailed analysis of its trading features, token diversity, fee structure, and community support, P2B Exchange stands out as a solid option—particularly for altcoin enthusiasts and traders looking to engage early with new projects. It’s not built for every kind of user, but it fills a clear niche in the ever-expanding crypto ecosystem.

Where P2B Exchange Excels

P2B’s strongest selling point is its listing focus on new and emerging crypto assets. For investors eager to discover tokens before they reach major exchanges, P2B provides consistent early access through its WE-Launch program and community voting initiatives.

The platform also benefits from a clean and beginner-friendly interface. Combined with a 15% trading fee discount (available with referral code “6d28e986”), it becomes a cost-effective solution for casual traders, new crypto users, and those seeking exposure to lower-cap projects without complicated onboarding requirements.

Its active listing schedule, staking support, and competitive trading environment help P2B stay relevant in a market dominated by bigger exchanges.

Things to Consider Before Joining

Despite its strengths, P2B has a few limitations to keep in mind. The platform lacks robust fiat deposit and withdrawal options, which may be inconvenient for users looking to convert crypto to traditional currency directly.

Liquidity on newer or niche tokens may also be inconsistent—an important factor for traders who rely on tight spreads and fast execution. Additionally, while the exchange is functional and growing, it may not yet have the brand trust or regulatory clarity of top-tier platforms like Binance or Coinbase.

Users focused on large-volume trading, advanced derivatives, or full KYC/AML compliance should review their needs carefully before committing.

Security and Growth Outlook

P2B has demonstrated steady growth through continuous listings, community interaction, and transparent promotion of new token opportunities. While it doesn’t lead the industry in security innovation, it employs standard protections like 2FA and wallet whitelisting and has thus far maintained a clean operational record.

Its commitment to listing transparency and user voting makes it a community-driven platform, and its streamlined rewards system gives users a clear reason to stay engaged.

Frequently Asked Questions (FAQs) About P2B Exchange Review

Is P2B Exchange Suitable for Beginners?

Yes, P2B is a beginner-friendly platform. Its clean user interface and straightforward trading process make it accessible to users who are new to crypto. While it doesn’t offer in-depth tutorials, the simplified navigation and low trading fees make it a good starting point for casual investors and first-time traders.

Which Countries Can Access P2B Exchange?

P2B Exchange is available in over 100 countries worldwide. It serves users across Asia, Europe, the Middle East, and Latin America. However, residents of countries under strict international sanctions—such as North Korea, Iran, and Syria—may face access restrictions due to compliance requirements.

Does P2B Exchange Support Fiat Deposits or Withdrawals?

Currently, P2B is a crypto-only exchange, meaning it does not support direct fiat deposits or withdrawals. Users looking to move funds from traditional bank accounts will need to first convert fiat to crypto using third-party services or peer-to-peer platforms before transferring to P2B.

How Secure Is P2B Exchange for Storing Crypto?

P2B uses standard industry security practices including cold wallet storage for most user funds, two-factor authentication (2FA), and withdrawal whitelisting. While no major security breaches have been reported to date, users are always encouraged to use personal hardware wallets for long-term asset storage.

How Do I Withdraw Funds from P2B?

To withdraw funds from P2B, go to the “Wallet” section of your dashboard. Select the cryptocurrency you wish to withdraw, enter the recipient wallet address, and confirm via 2FA. Depending on the network load and blockchain confirmations, withdrawals are typically processed within 30–90 minutes.